Dr. Laffer is interviewed about the origin story of “The Laffer Curve,” his involvement in political and economic history, taxes during the Great Depression, the use of tariffs, and if the United States would ever add a consumption tax.

When You’re Right, Well, You’re Right: Laffer Curve

In this lesson, Dr. Laffer details the origins, practical uses, and theory behind the Laffer Curve. The Laffer Curve looks at the relationship between tax rates and tax revenues. The basic theory behind this relationship is that changes in tax rates have two effects on revenues: the arithmetic effect and the economic effect. The arithmetic…

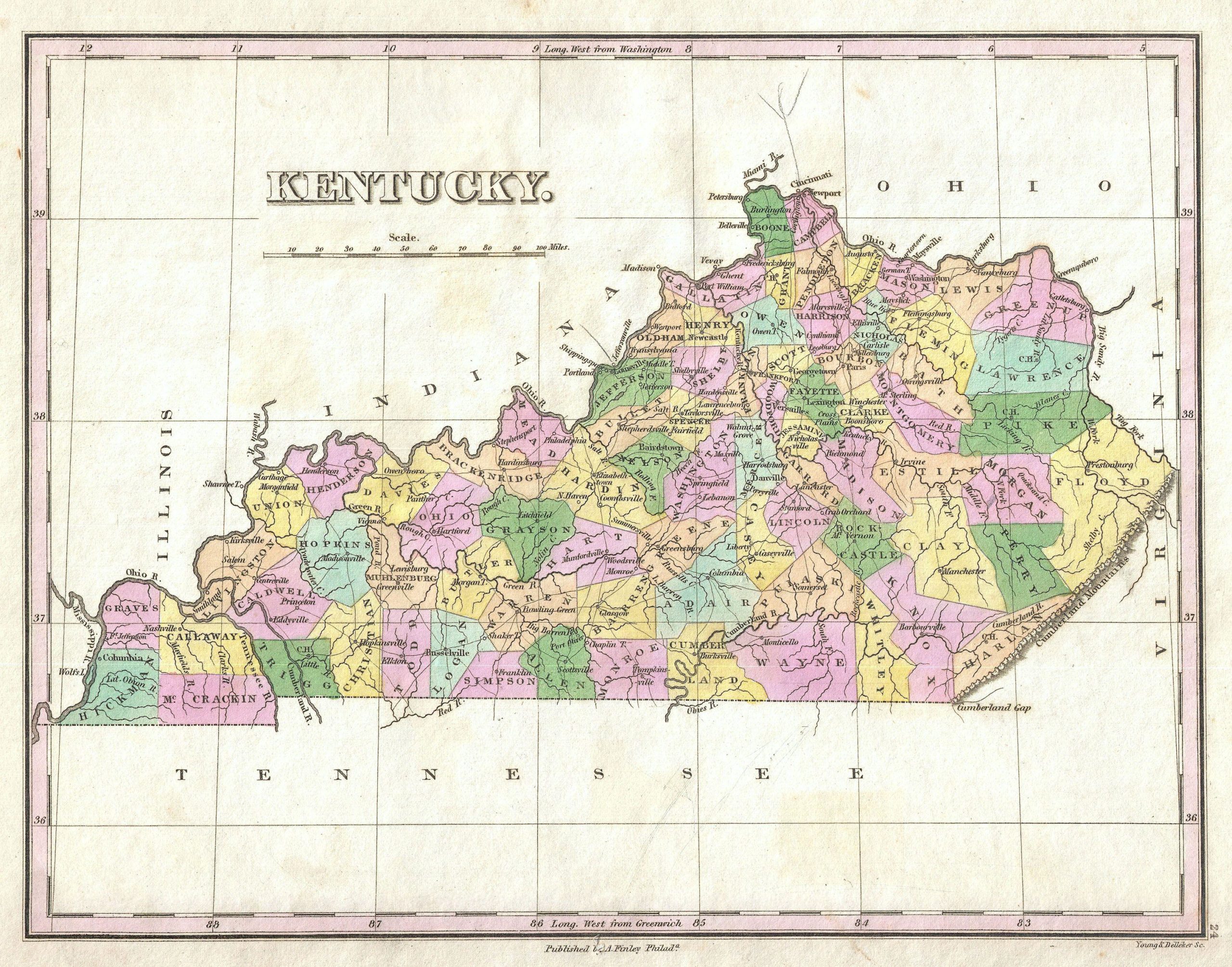

This comprehensive study on Kentucky’s economic history and prosperity agenda examines state revenue, pensions, tax structure, and political corruption. While Kentucky’s economic performance has historically ranked poorly, Dr. Laffer offers remedies for a path forward. Link to study: The Commonwealth of Kentucky - An Economic History and Prosperity Agenda

For many countries around the world, the challenge of administering effective tobacco taxation has been to ensure the optimal level and structure of taxation that achieves the public health and public finance goals of governments. As I pointed out in my book, Handbook of Tobacco Taxation: Theory and Practice, many people believe that tax policies on tobacco…