Chapter 2: Income Tax Avoidance—The Income of the Rich Is Not What It Seems

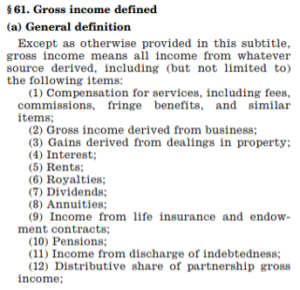

1. “Gross income defined” by the law, in the United States Code:

….and including further items.

2. Andrew Mellon’s Taxation: The People’s Business may be found here.

The superb biography of Mellon is David Cannadine, Mellon: An American Life (New York: Vintage, 2008)

3. The Cohan rule.

Learned Hand wrote in his opinion defining the rule:

In the production of his plays Cohan was obliged to be free-handed in entertaining actors, employees, and, as he naively adds, dramatic critics. He had also to travel much, at times with his attorney. These expenses amounted to substantial sums, but he kept no account and probably could not have done so….

Cohan v. Commissioner of Internal Revenue, 39 F.2d 540, 543 (2d Cir. 1930)

The two aspects of the rule came to be those associated with 1) “free-handed” and “substantial sums”—if one’s business requires significant expenditures on entertainment and the like, those expenses are deductible; and 2) “but he kept no account”—meaning that estimates in lieu of receipts were acceptable for tax purposes (this matter remaining a nub of contention in tax law for years).

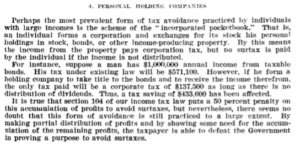

4. Personal holding companies

Especially after the top rate of the income tax went to 63 percent in January 1932, wealthy individuals formed “personal holding companies” to take income from assets they did not need for current consumption. As Congressional testimony put it at the time:

A personal holding company could also either: 1) pay out salary (deductible from the corporate rate) or a dividend (exempt from the small individual “normal tax” but not the large “surtax”) just in the amount of expected consumption, with the other income retained as earnings only taxable at the lower corporate as opposed to the individual rate. This strategy ensured that a rich person paid individual income taxes only on consumption income, and kept income devoted to savings free from such taxation;

A personal holding company could also either: 1) pay out salary (deductible from the corporate rate) or a dividend (exempt from the small individual “normal tax” but not the large “surtax”) just in the amount of expected consumption, with the other income retained as earnings only taxable at the lower corporate as opposed to the individual rate. This strategy ensured that a rich person paid individual income taxes only on consumption income, and kept income devoted to savings free from such taxation;

or 2) pursue the legally questionable strategy of counting family members and close friends, associates, and partners-in-consumption as employees and spreading out salary payments to those individuals so that such payments might barely reach up the income tax rate schedule in each case.

The above is page 53 in the House Ways and Means Committee hearings on the matter, from 1933-34 here.

See the Senate hearings here.

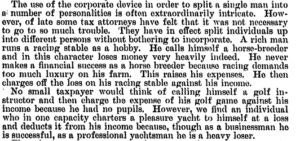

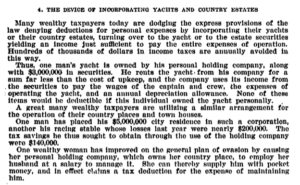

5. The incorporation of leisure pursuits was a version of the personal holding company. As Treasury Secretary Morgenthau described such devices before Congress in 1937:

He went on and on even beyond this passage:

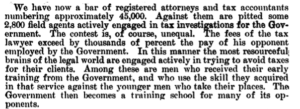

In these same extensive hearings on “tax evasion and avoidance,” Morgenthau made his statement about the impossibility of the revenue bureau catching up to the avoidance practices. The government was training the best experts in the field:

In these same extensive hearings on “tax evasion and avoidance,” Morgenthau made his statement about the impossibility of the revenue bureau catching up to the avoidance practices. The government was training the best experts in the field:

Joint Committee Hearings on Tax Evasion and Avoidance, 1937, pp. 4, 10, 12 and ff. See the full text here.

Joint Committee Hearings on Tax Evasion and Avoidance, 1937, pp. 4, 10, 12 and ff. See the full text here.

6. The community property conversion mania before 1948

Find Stephanie Hunter MacMahon’s remarkable article on this history here:

https://scholarship.law.uc.edu/cgi/viewcontent.cgi?article=1094&context=fac_pubs

Stephanie Hunter McMahon, “To Save State Residents: States’ Use of Community Property for Federal Tax Reduction, 1939-1947,” 27 Law & Hist. Rev. 585 (2009).

7. Judge Learned Hand

The standard biography is Gerald Gunther, Learned Hand: The Man and the Judge (New York: Oxford University Press, 2011)

8. Capital Gains and the Swindle Sheet

The commodious hearings the House Ways and Means Committee held on this issue are in three volumes, accessible here:

For discussions of these hearings, and their decisiveness on setting a 65 percent (as opposed to the current 91 percent) as a goal for the top income tax rate just prior to the Kennedy years, see Larry Kudlow and Brian Domitrovic, JFK and the Reagan Revolution: A Secret History of American Prosperity (New York: Portfolio, 2016), and Julian E. Zelizer, Taxing America: Wilbur D. Mills, Congress, and the State, 1945-1975 (New York: Cambridge University Press, 1998).

9. Tom Wolfe’s observations pertaining to tax-avoidance culture

Tom Wolfe’s characterization of lunch in Manhattan, and in Silicon Valley, came in Esquire in 1983, reprinted in the collection Hooking Up in 2000. See here.

The essay was an extended piece on the co-founder of Intel, Robert Noyce, and is widely acknowledged as a modern masterpiece of long-form business history.

In his compendium of art criticism corresponding to the postwar decades of corporate collecting, Hilton Kramer made this observation in 1973:

“The only question still under debate is whether the avant-garde persists into our own day as a vital artistic force or has given way to something else—an age in which the rhetoric and attitudes of the avant-garde continue to be upheld, but very largely as a cover for a mode of artistic production and consumption that differs from the Age of the Avant-Garde in its fundamental assumptions.”

Kramer had become stunned at how previously renegade avant-garde art had become “consumption” items on large scale in the post-World War II period.

Hilton Kramer, The Age of the Avant-Garde: An Art Chronicle of 1956-1972 (New York: Farrar, Straus and Giroux, 1973), ix.

10. Photos of One Chase Manhattan Plaza on its dedication in 1963 may be found on ArchDaily here.

11. Bill Gates, Warren Buffett, John Brooks

Bill Gates in 2014:

“Not long after I first met Warren Buffett back in 1991, I asked him to recommend his favorite book about business. He didn’t miss a beat: “It’s Business Adventures, by John Brooks,” he said. “I’ll send you my copy.” I was intrigued: I had never heard of Business Adventures or John Brooks.

“Today, more than two decades after Warren lent it to me—and more than four decades after it was first published—Business Adventures remains the best business book I’ve ever read. John Brooks is still my favorite business writer. (And Warren, if you’re reading this, I still have your copy.)”

In Gates’s commentary on the book in his Gatesnotes blog, and in an accompanying video also offering Buffett’s, the two titans mention a number of chapters in the book, including those on Ford Motor Company, Xerox, and General Electric, but do not comment on the 43-page-long third chapter on tax avoidance by the corporate elite. Gates’s touting of the book in 2014 occasioned the book’s reprinting for the first time since 1971.

In 2018, Gates said that he had paid more taxes than anyone in history, over $10 billion, or well less than a tenth of his net worth at that point ($91 billion) plus past consumption and gifts to charity. Therefore, Bill Gates’s tax rate has effectively been less than 10 percent. Moreover, Gates amassed his wealth largely in Washington, a zero-income-tax state. Washington’s fortunes since Microsoft’s setting up headquarters in the state in 1979 have been excellent. Since 1978, Washington’s gross state product has exceeded the increase in the nation’s GDP by some 138 percent (statistics from the BEA).

See Gatesnotes: The Blog of Bill Gates, July 13, 2014