The Laffer Curve is one of the main theoretical constructs of supply-side economics, and is often used as a shorthand to sum up the entire pro-growth world view of supply-side economics.

However, the Laffer Curve itself simply illustrates the tradeoff between tax rates and the total tax revenues actually collected by the government.

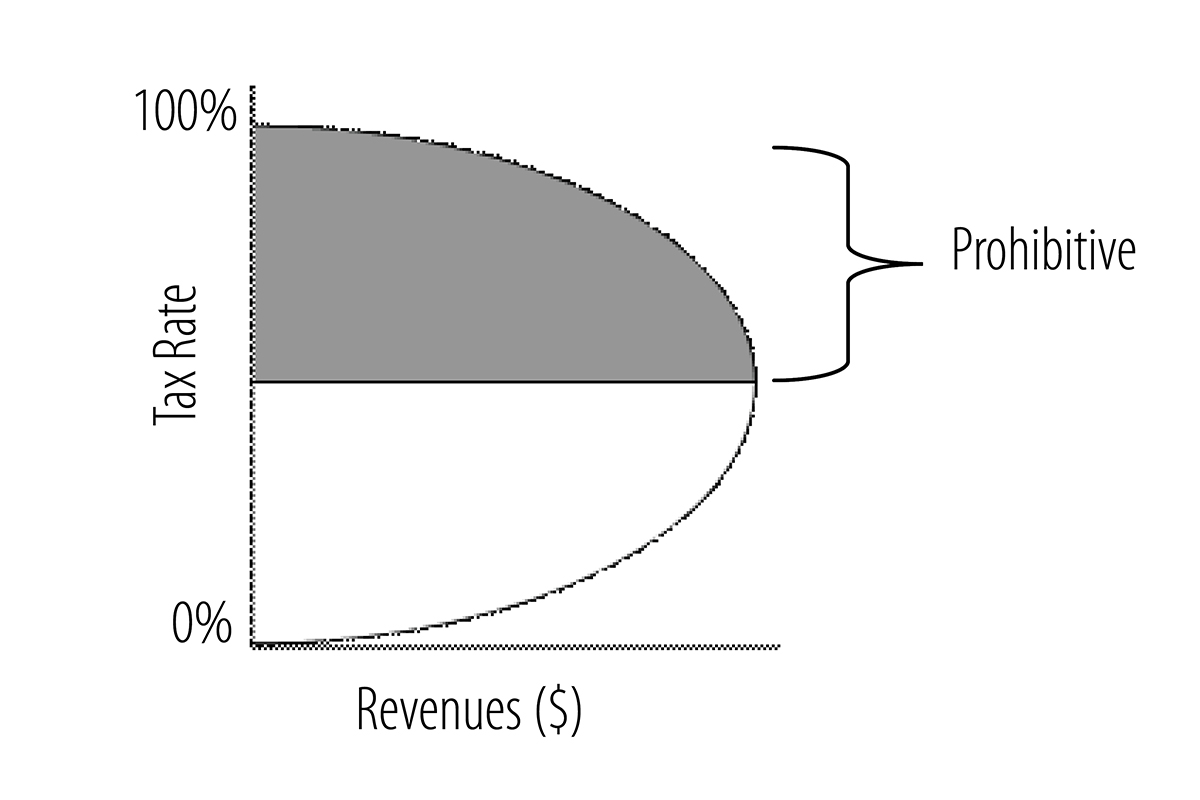

As drawn, the Laffer Curve shows that at a tax rate of 0%, the government would collect no tax revenue, just as it would collect no tax revenue at a tax rate of 100% because no one would be willing to work for an after-tax wage of zero.

The reason for this is that tax rates have two effects on revenues: one is arithmetic, the other economic. The arithmetic effect is static, meaning that if rates are lowered, the tax revenues per dollar of tax base will be lowered by the amount of the decrease in the rate, and vice versa for increasing tax rates. In other words, this is what happens when a hypothetical 1% tax collects $1 million, so people assume that a 2% tax would collect $2 million… and a 5% tax would collect $5 million. Likewise, under the same scenario people would similarly assume that a .5% tax rate reduction would collect only $500,000.

The economic effect recognizes the positive impact that lower tax rates have on work, output, and employment, which provide incentives to increase these activities. By contrast, raising tax rates penalizes people for engaging in these activities. The Laffer Curve demonstrates what happens when the economic and arithmetic effects collide, explaining why a tax increase may reduce taxed activity and raise less revenue than otherwise predicted, just as a tax cut may increase taxed activity and raise more revenue than otherwise predicted.

Importantly, the Laffer Curve does not say whether a tax cut will raise or lower revenues, nor does it predict that any and all tax rate reductions would necessarily bring in more total revenues. Instead it says that tax rate reductions will always result in a smaller loss in revenues than one would have expected when relying only on the static estimates of the previous tax base. This also means that the higher the starting tax rate, the more dramatic the supply-side stimulus will be from cutting the tax rate. It is possible that this economic effect will swamp the arithmetic effect, causing an actual increase in tax revenue.

However, the Laffer Curve does not say that “all tax cuts pay for themselves” as many people claim. What is true is that tax rate cuts will always lead to more growth, employment, and income for citizens, which are desirable outcomes leading to greater prosperity and opportunity. There is, after all, more to fiscal policy than simply maximizing government revenue.

The Story Behind the Laffer Curve

The Laffer Curve earned its name from a 1978 article by the late Jude Wanniski (then-associate editor of the Wall Street Journal) appearing in The Public Interest entitled, “Taxes, Revenues, and the ‘Laffer Curve.’” In his subsequent book The Way the World Works, Wanniski recounted a 1974 dinner he attended with Arthur Laffer (then a professor at the University of Chicago), Donald Rumsfeld (chief of staff to President Gerald Ford), and Dick Cheney (Rumsfeld’s deputy and a former classmate of Laffer’s). When the foursome’s dinner discussion turned to President Ford’s “WIN” (Whip Inflation Now) proposal for tax increases, Dr. Laffer is said to have grabbed his napkin to sketch the curve as an illustration of the tradeoff between tax rates and tax revenues. Wanniski dubbed the tradeoff described as the “Laffer Curve.”

As to Wanniski’s recollection of the story, Dr. Laffer has said that he cannot remember the details, but he does recall that the restaurant where they ate used cloth napkins and his mother had taught him not to desecrate nice things. He notes, however, that it could well be true because he used the so-called Laffer Curve all the time in classroom lectures and to anyone else who would listen.

Although the Laffer Curve bears his name, the ideas behind it were not new or his alone. In fact, Dr. Laffer likes to point out that the ideas are so straightforward that people knew about it hundreds of years before. For example, the Muslim philosopher, Ibn Khaldun, wrote in his 14th century work, The Muqaddimah: It should be known that at the beginning of the dynasty, taxation yields a large revenue from small assessments. At the end of the dynasty, taxation yields a small revenue from large assessments.

Yet the significance of the Laffer Curve ought not be minimized. While it is true that the concept preceded Dr. Laffer, that dinner in 1974, and Wanniski’s article some four years later, this view of tax rates and revenues was not widely accepted.