Laffer went to Stanford business school from 1963-65 and was an economics doctoral student from 1965-72. He received the MBA degree in 1965 and the PhD in 1972. At Stanford, his major influences were the economists Paul Baran (a Marxist) and dissertation committee members Edward S. Shaw and Ronald I. McKinnon and adviser Emile Despres. Each one of these economists conferred an influence on Laffer that shaped his economics for years to come.

Paul Baran, the collaborator with Paul Sweezy on Monopoly Capital (1966), developed the concept of the gross economic “surplus.” Thus was all economic production beyond what was needed for survival. Baran, in unmistakable agit-prop Marxist fashion, asked whether the surplus was as well-constructed as it might be. Like John Kenneth Galbraith in The Affluent Society, Baran wondered if all the extra stuff the United States had been accumulating lately, from cars to private schools to fancy office buildings, was the best stuff that could have been produced, from an ethical perspective, in excess of basic necessities.

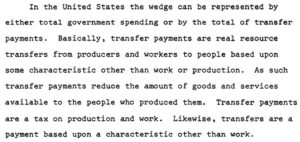

Baran calculated that the surplus in the United States was regularly near 50 percent of total economic output and growing over the long term. Here is Baran and Sweezy’s chart from Monopoly Capital:

Baran and Sweezy, Monopoly Capital: An Essay on the American Economic and Social Order (Monthly Review Press, 1966), 382.

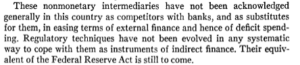

In the 1970s, Laffer drew inspiration from Baran’s work as he outlined his concept of the “wedge.” This was the total amount of imposition that the government puts on private economic transactions. Because people had to pay for government, the taxes and bond payments financing government represented a “wedge” that amounted to a cost of doing business. Regulations and costs of compliance added to the wedge. The wedge amounted to about 35 of GDP percent by 1975, in Laffer’s calculations. Therefore government was gobbling up the greater part of what the economy threw off as the surplus.

A portion of congressional testimony of Laffer’s of 1976 explaining the wedge:

From Arthur B. Laffer, testimony for the Full Employment and Balanced Growth Act, 1976 (Subcommittee on Employment, Poverty, and Migratory Labor of the Committee on Labor and Public Welfare), May 1976.

Supply-side economics began with a premise that it held in common with classical Marxism: that economies that have experienced an industrial revolution are good at producing abundant economic output. Baran was concerned that the majority of this “surplus” went to wasted and unenlightened consumption. Laffer was concerned that a great part of it went unproductively to the government—meaning that the cost of private production could be much lower if government got smaller.

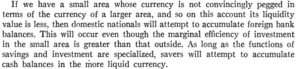

Edward S. Shaw was another mentor. In 1960, he and economist John G. Gurley published what soon became a classic in the field, Money in the Theory of Finance. This book held that a great amount of functional money in the economy did not fall under the control of macro-institutional authorities such as the Federal Reserve. There was a great deal of “inside money”—financing arrangements from customers to clients, for example—that functioned as money as much as anything emanating from the Fed or the official banking system. As Gurley and Shaw wrote in 1955:

Inspired by this work, Laffer challenged the monetarist view that the supply of money could be counted and targeted if not controlled by the Federal Reserve. His chief statement in this area was his 1970 paper in the Journal of Political Economy, “Trade Credit and the Money Market.” This article indicated that monetary aggregates were missing upwards of half of the economy’s functional money supply. Laffer was particularly interested in “unutilized trade credit”—credit that a business making purchases could get on demand, and outside of the banking system, if the economic opportunity arose.

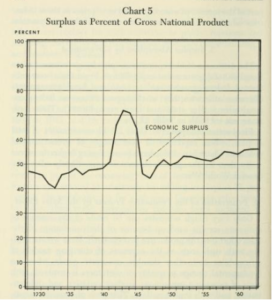

Ronald McKinnon was probably the one who introduced Laffer to the economics of Robert Mundell. McKinnon was a student and an advocate of fixed exchange rates and resisted the growing chorus in favor of floating rates and an ending of the dollar’s definition in gold. In 1963, in the AER, McKinnon assessed Mundell’s recently elaborated theory of optimum currency areas, the work that would in part bring Mundell the Nobel Prize in 1999.

In this article, McKinnon confirmed, with Mundell, that a place that uses one currency is equivalent in that respect with economies connected to each other via fixed exchange rates. Characteristically, he argued that deviations from fixed exchange rates lead to economic efficiency losses, a contention that Laffer would make repeatedly in the late 1960s and early 1970s:

In addition, McKinnon examined the degree a country trades with the world as a determinant of whether it should have a fixed or a floating rate. Whether a small country with a comparatively diversified and autarkic economy, or an economically specialized and integrated country, or a larger country whose economy is integrated but with a smaller proportion of tradeable production, were central issues Laffer wrote about after tutorials from McKinnon. Chiefly, they are the themes of Laffer’s “Anti-Traditional Theory of the Balance of Payments Under Fixed Exchange Rates,” which Laffer wrote in 1967 after McKinnon showed him Mundell’s pre-print paper “Growth and the Balance of Payments” (which would come out in 1968). Laffer’s “Anti-Traditional” paper, with Mundell’s work, launched the field of “the monetary approach to the balance of payments” in the 1970s. A compendium on this subject is here.

Emile Despres was Laffer’s adviser and a dedicated supporter of the Bretton Woods system of fixed exchange rates and dollar redeemability in gold, to foreign monetary authorities. See here on this website for Despres’s contributions to the gold/fixed rate debate.