In the Journal of Finance in 1972, Fischer Black offered a disproof of the possibility of monetary policy. He tested the notion of “active” monetary policy in “equilibrium conditions,” in which all activities in the market naturally clear. He felt no need to test active monetary policy in chronic disequilibrium conditions, such as those supposed by Keynesianism and monetarism, because he thought those were fantastical.

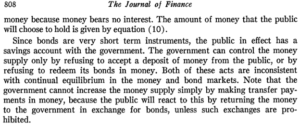

Black dismissed monetary policy as “active” because all money-supply decisions are made by the public, as opposed to the central banking authority:

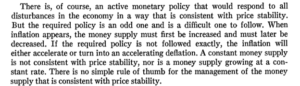

Moreover, Black wondered how the mathematics would work out if he conceded the point that monetary policy could be meaningfully active:

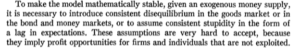

As for disequilibrium theories such as Keynesianism and monetarism—the former stressing that markets clear below full employment and the latter that the market cannot get the money supply right—Black wondered how they could abide the arbitrage they would necessarily incur:

From Fischer Black, “Active and Passive Monetary Policy in a Neoclassical Model,” Journal of Finance 27, no. 4 (Sept. 1972)