Inequality: Are the rich cashing in? | Head to Head

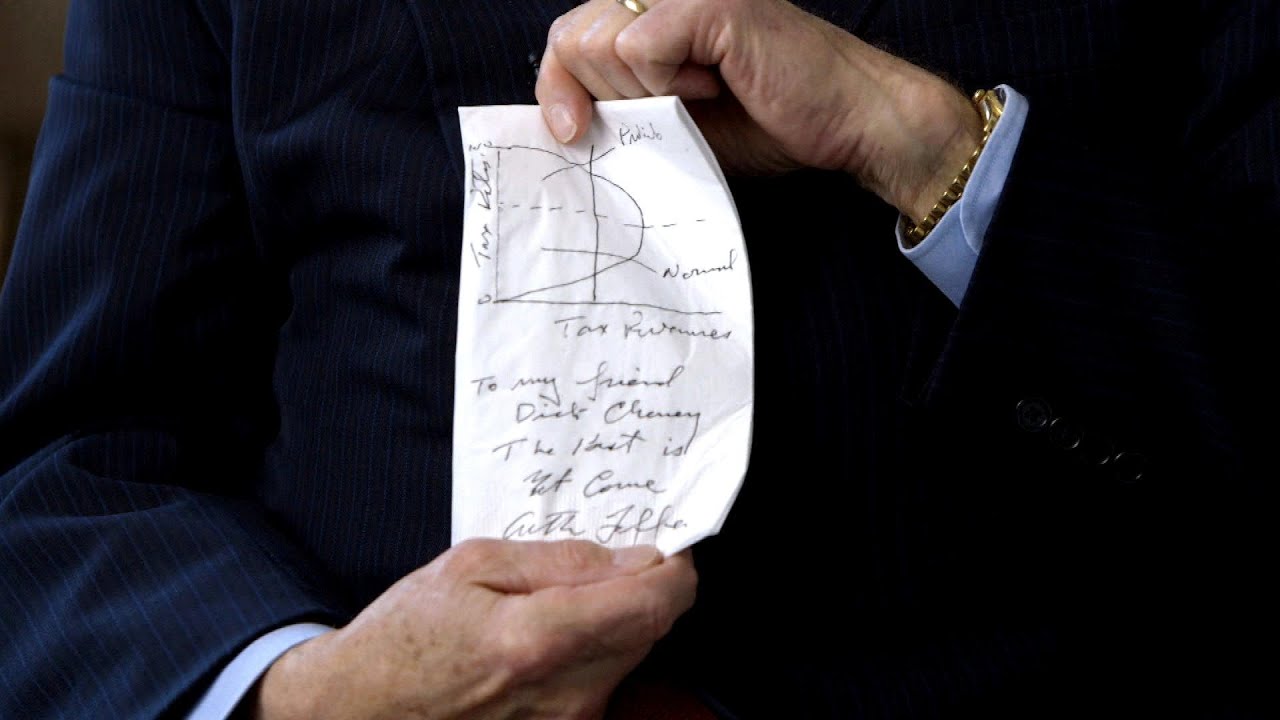

“You don’t want to make the rich poor; you want to make the poor richer,” says Dr. Arthur Laffer, an economist who laid the intellectual foundations for Ronald Reagan and Margaret Thatcher’s right-wing policies in the 1980s. But should we really be cutting services to the poor while we cut taxes for the rich? Has the spread of ‘Reaganomics’ really helped the world’s poor? In this episode of Head to Head, Mehdi Hasan challenges Dr. Arthur Laffer on whether free market economics still makes sense in the wake of the financial crisis, and on his famous ‘Laffer Curve,’ through which he advocates cutting taxes on high earners. Dr. Arthur Laffer has been described as “the father of supply-side economics”.