1. Low Rate, Broad Based Flat Tax

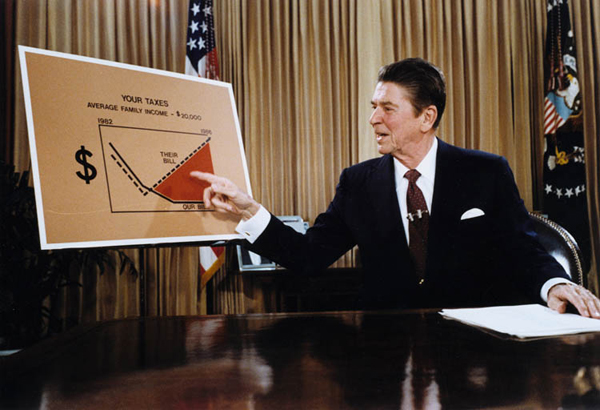

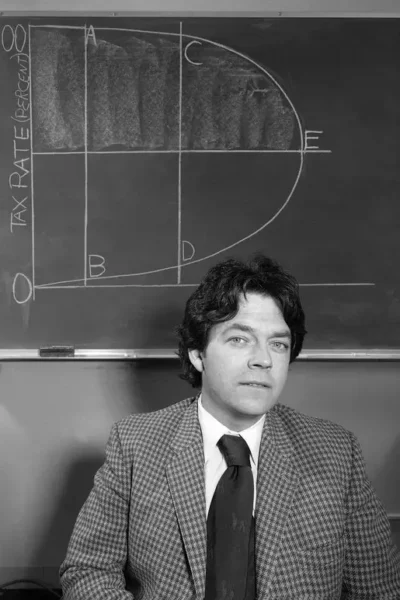

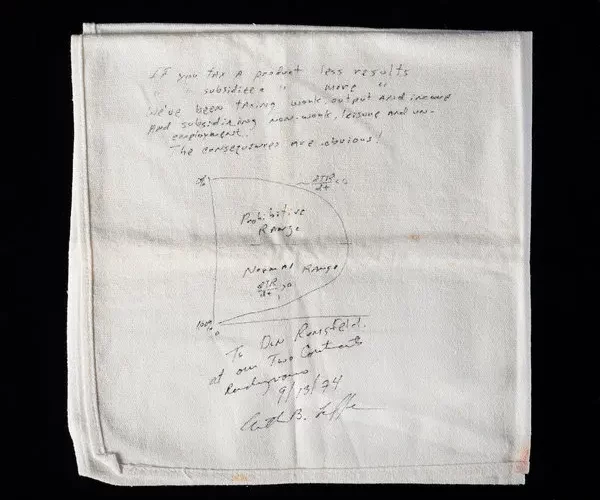

Taxes are negative in nature: we tax speeders to stop speeding, we tax alcohol to stop drinking, and we tax smokers to stop smoking. Thus, a low rate is necessary to provide people with the least incentives to avoid, evade, or otherwise not report taxable income; a broad tax base is necessary to provide taxpayers with the least number of places where they can put their money to not have to pay taxes. And a negative system should never include tax expenditures (i.e. positive incentives, such as tax credits or exemptions)—if a program is good enough to deserve a tax break, it’s even better to receive the money transparently through a government check. A country needs a low rate, broad based flat tax with no exemptions, no exclusions, no deductions, no credits, nothing in order to provide the greatest incentives to increase employment, output and production.

2. Spending Restraints

Government spending is taxation. To see just why government spending is taxation, imagine two farmers, Farmer A and Farmer B, where there’s no one else except for Farmer A and Farmer B. If Farmer B gets unemployment benefits, who do you think is going to pay for those benefits? Farmer A. Government spending, such as unemployment benefits to Farmer B, is taxation for Farmer A. However, when government takes from people who have more, those people’s incentives to earn income are reduces, and they will produce less. And when government gives that money to people who have less, those people have an alternative source of income other than working and they, too, will produce less.

Overall, when it taxes and spends, government causes the market to shift away from activities now considered by the market to be less attractive, thereby reducing the income and the demand of all productive factors being taxed. Government should therefore collect taxes up to the point where, for the last dollar of taxes collected, the damage done is a little bit less than the benefit done by the last dollar of government money spent. And then government should stop taxing and spending, and should not spend any excess tax revenues.

3. Sound Money

There is nothing that can bring an economy to its knees quicker than unsound money. The prime directive of monetary policy is to stabilize prices, thereby eliminating inflation. Taking today as an example, artificially low interest rates are hurting the ability of the U.S. and global economy to achieve growth targets. The market must be allowed to clear at the correct interest rate by allowing supply and demand to determine an equilibrium rate.

4. Free Trade

Free and unencumbered trade amongst the many nations of this world is truly a win/win situation for every single country. Each and every country has some things it makes more efficiently than other countries, and those other countries, in turn, make other things more efficiently (i.e. more output with fewer inputs) than yet other countries. Get rid of tariffs and other non-tariff barriers and make it a free trade, competitive world.

5. Minimal Regulation

The key function of regulatory policy is one of limitations to avoid unintended detrimental consequences. Everyone knows there have to be regulations, but we also want to make sure that regulations do not go beyond the purpose for which they were intended and thereby do collateral damage to the overall economy.