Chapter 10: High Tax Rates and the Sluggish 1950s

1. Compensating the Corporate Executive

The 2-volume, 1,100-page Compensating the Corporate Executive, issued once a decade from the 1940s to the 1960s, is an essential source for assessing the scope and detail of tax-avoidance strategies among high earners in the high-tax era.

An excerpt from its section on perquisites:

![]()

(pp. 193-96; see Taxes Have Consequences for full citation)

2. Piketty, Saez, and Stantcheva make this observation:

Not the anecdotal evidence but the logic of price theory dictates that if the relative price of income vs. perquisites falls, income in lieu of perquisites will be gained. This is the question that the cuts in progressive tax rates beginning with the Kennedy bill of 1963 raise. Moreover, the evidence base of executive “intermediate consumption” in the era of high tax rates overwhelms any characterization of “anecdotal.” That source base is huge. Tax avoidance looms immense over the history executive leadership in the 1950s and early 1960s.

Thomas Piketty, Emmanuel Saez, and Stefanie Stantcheva, “Optimal Taxation of Top Labor Incomes: A Tale of Three Elasticities,” American Economic Journal: Economic Policy 6, no. 1 (Feb. 29014), 230-71. ree

3. Stanley Surrey

Selections from Harvard law professor’s Stanley Surrey’s law review observations from the high-tax 1950s:

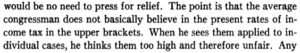

The average congressman does not basically believe in the present rates of the income tax in the upper brackets”:

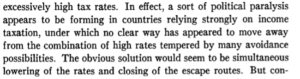

“High rates tempered by many avoidance possibilities”—

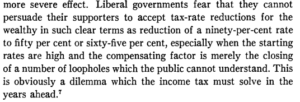

And “the starting rates are so high” – lowering, say, the 91 percent rate might jeopardize the acceptance of the 20 percent rate. Throughout the tax discourse of the high tax years, the high top rate ran interference for the lowest rate’s itself being high:

A footnote canvassing extensive literature on tax “erosion.” The term referred to the divergence between statutory and effective tax rates:

From Stanley S. Surrey, “Congress and the Tax Lobbyist: How Special Provisions Get Enacted,” Harvard Law Review 70, no. 7 (May 1957)